vermont sales tax exemptions

SALES AND USE TAX Subchapter 002. Vermont Sales Tax Exemption Form August 22 2022 April 28 2022 by tamble These include the Contractors Exemption Certificate Assistance in Fight MIT and Quasi-Govt.

Vermont Vt Tax Exempt On Your Mark

The Burlington Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Burlington local sales taxesThe local sales tax consists of a 100 city sales tax.

. 53 rows Exemption extends to sales tax levied on purchases of restaurant meals. 9741 9741. Step 1 Begin by downloading the Vermont Certificate of Exemption Form S-3.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. New State Sales Tax Registration. Taxation and Finance Chapter 233.

S tep 2 Check whether the. How to use sales tax exemption certificates in Vermont. Beer over 6 percent alcohol by volume.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Additionally wholesalers must pay a tax on spirits and fortified wines as follows. PdfFiller allows users to Edit Sign Fill Share all type of documents online.

The Vermont Statutes Online Title 32. Ad The Leading Online Publisher of National and State-specific Legal Documents. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the. Ad Vermont Sales Tax Exemption Certificate information registration support. Taxpayers in Vermont engaged in the manufacturing industry should review their production process determine which items are defined as included in the integrated plant and.

Sales up to 500000. Get the Avalara Tax Changes Midyear Update today. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Steps for filling out the S-3 Vermont Certificate of Exemption. Ad Download or Email Form F0003 More Fillable Forms Register and Subscribe Now. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Get Access to the Largest Online Library of Legal Forms for Any State. Get the Avalara Tax Changes Midyear Update today. Ad Keep up with changing tax laws.

This page discusses various sales tax exemptions in Vermont. Ad Keep up with changing tax laws.

How To File And Pay Sales Tax In Vermont Taxvalet

Sales Tax Exemption For Building Materials Used In State Construction Projects

Vermont Senate Passes Sales Tax Exemption For Menstrual Products Vtdigger

Vermont Sales Tax Calculator And Local Rates 2021 Wise

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vermont Sales Tax Exemption Certificate For Form S

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

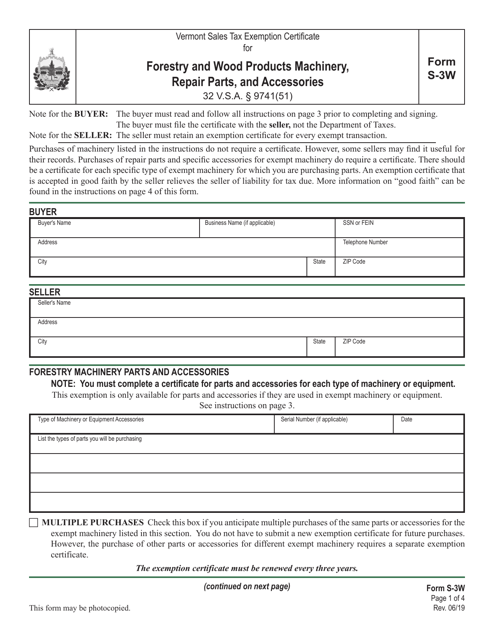

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

Printable Vermont Sales Tax Exemption Certificates

Vermont Grid Tie Solar Pv Installations O Meara Solar

How Are Groceries Candy And Soda Taxed In Your State

Fillable Online Form S 3 Vermont Sales Tax Exemption Certificate For Purchases For Fax Email Print Pdffiller

Vermont Managing Sales Tax Exemptions In The Agriculture Industry Avalara

Vermont Sales Tax Exemption Certificate For Form Agricultural Fill And Sign Printable Template Online Us Legal Forms